japan corporate tax rate 2019 deloitte

The rate of tax on dividend income received in excess of the standard rate band is 381. Japan Income Tax Tables in 2019.

Streaming Video Churn Accelerating Deloitte Insights

In terms of corporate tax RD tax.

. The majority of the 218 separate jurisdictions surveyed for the year 2019 have corporate tax rates below 25 percent and 111 have tax rates between 20 and 30 percent. The income tax rates allowances thresholds rates and other payroll deductions and allowances displayed on this page are used by the 2019 payroll and tax calculators to calculate relevant. To income tax at the top rate of income tax which is 45.

Chapter 3 - Tables 37 to 314 - Taxes as of GDP and as of Total tax revenue. Effective tax rate of 3086. Chapter 3 - Table 315 - Tax revenues of subsectors of general government as of total tax revenue.

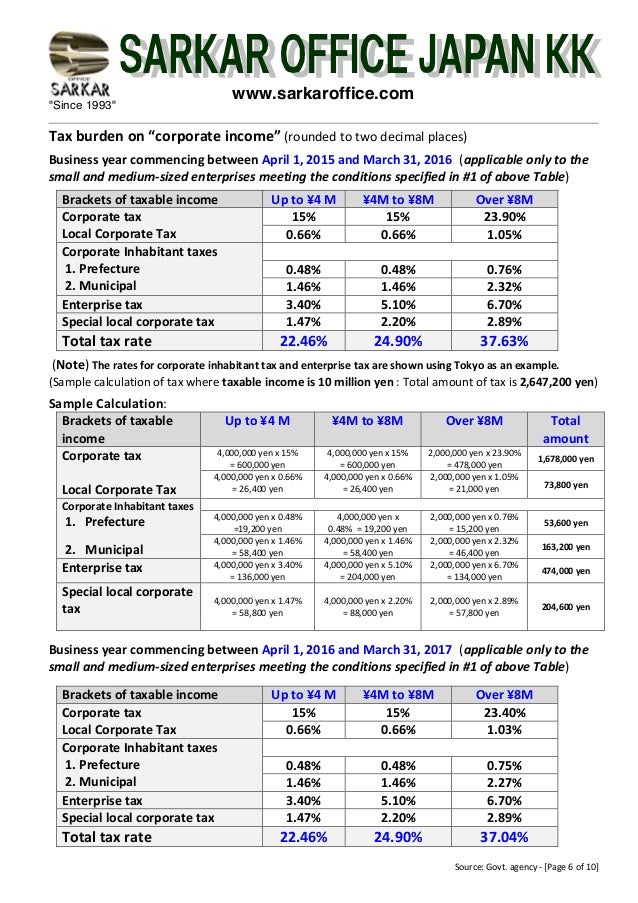

In the case that a. However the WHT rate cannot exceed 2042 including the income surtax of 21 on any royalties to be received by a non-resident taxpayer of. Tax rates for companies with stated capital of more than JPY 100.

However the effective rate does not take into account any differences in what is included in taxable income from country to country or any investment incentives or special tax regimes. The rate is increased to 10 to 15 once the tax audit notice is received. 96 67 96 70 Local corporate special tax or special.

On 14 December 2018 proposals for the 2019 tax reform were approved by the Liberal Democratic Party LDP and the New Komeito Party. 6 rows 73 53 Over JPY 8 million. Tax Rate applicable to fiscal years beginning between 1 April 2018 and 30 September 2019.

Legislation will be introduced in Finance Bill 2020 to repeal the previously enacted reduction to the main rate of corporation tax to 17 thereby maintaining the current main rate of corporation. An under-payment penalty is imposed at 10 to 15 of additional tax due.

Economic Survey Of Japan 2008 Reforming The Tax System To Promote Fiscal Sustainability And Economic Growth Oecd

Deloitte Online Tools For Covid 19 Tax And Fiscal Measures Deloitte China Tax Services

Scale Up Strategy For Biotech Companies Deloitte Insights

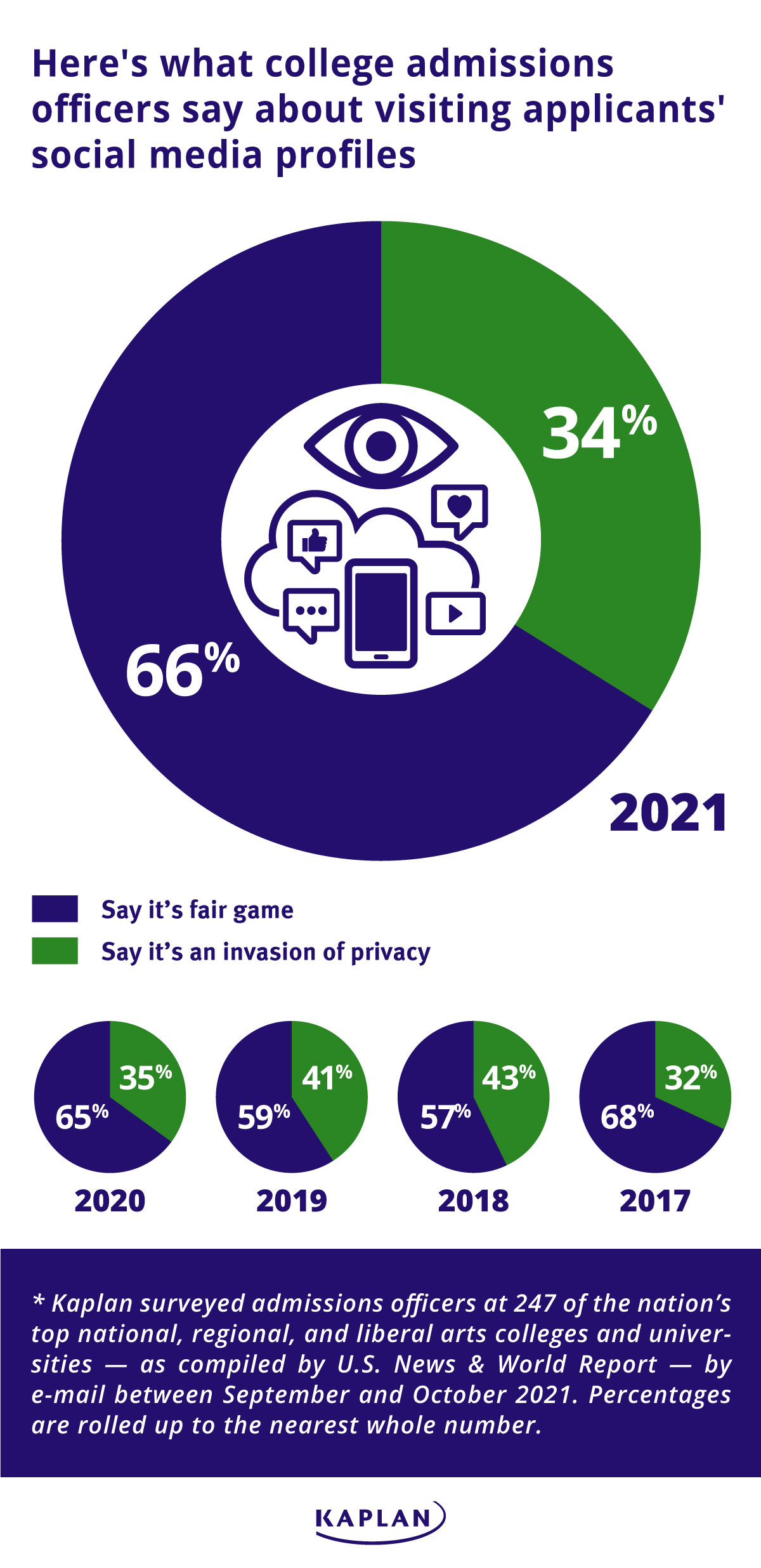

Kaplan Survey The Percentage Of College Admissions Officers Who Say Applicants Social Media Content Is Fair Game Ticks Up Business Wire

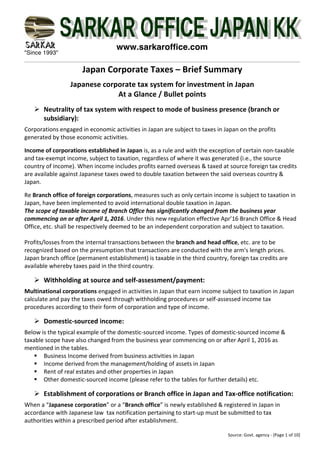

Japanese Corporate Tax At A Glance In Bullet Points

Corporate Tax Rates Around The World Tax Foundation

Japanese Corporate Tax At A Glance In Bullet Points

Global Corporate And Withholding Tax Rates Tax Deloitte

Big Four Firms Ey Deloitte Report Higher Revenue Wsj

Global Minimum Corporate Tax Rate Wikipedia

A Tax Lens On The Proliferation Of Digital Assets Deloitte Us

Tax Articles And Insights Deloitte Us

Transforming Tax Operations Deloitte Insights

Corporate Tax Rates Around The World 2019 Tax Foundation

Corporate Tax Rates Around The World 2019 Tax Foundation

Earnings Stripping Rules And The Potential Impact On Asset Deals In Japan Deloitte Japan

Minimum Tax Proposal Would Create Complications For Investors And Companies Tax Experts Say Wsj